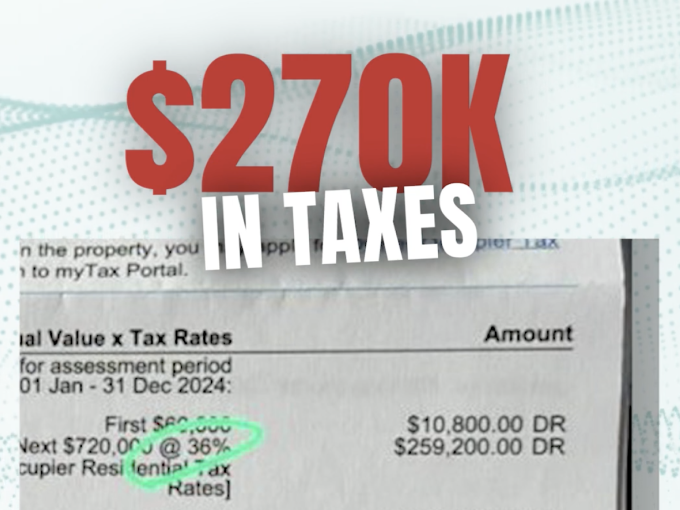

Recently, a lot of people on social media have been talking about their property tax bills—and they’re not happy. Imagine paying $20,000 in taxes last year and getting hit with a $270,000 bill this year! That’s a huge jump, and it’s important to understand why this is happening to so many homeowners.

What Determines Your Property Tax?

Your property tax depends on two main things: the Annual Value (AV) of your property and the tax rate set by the government.

1. Understanding Annual Value

The AV is basically what the government thinks your property could earn in rent for a year. Since rental prices have shot up by 50% to 100% since COVID-19, the AVs have increased too. That means higher taxes.

2. Different Tax Rates for Different Folks

There are different tax rates depending on whether you live in your property or rent it out. Both rates have gone up this year, which means everyone is paying more, especially investors.

How Much More Are Investors Paying?

Let’s say you’re an investor. Before, if your property’s AV was $60,000, you might have paid up to 14% in taxes. Now, that rate has jumped to 24%. And for the really high-value properties, where the AV is over $60,000, the tax rate is now a whopping 36%.

For example, if you rent your property for $20,000 a month, your new tax bill would be $75,800. That’s huge!

Why the Big Increase?

The government probably raised the rates to deal with changes in the economy, like making housing more affordable or balancing their budget. But when your rent goes up a lot, like it has recently, your tax bill will too.

What Does This Mean for Everyone?

This increase in property taxes might make some people think twice about investing in more property, or it might cool down a hot rental market. It’s definitely making a lot of people check their budgets more closely.

Conclusion

It’s been a shock for many to see their property tax bills go up so much this year. It’s crucial for homeowners and investors to keep up with how these taxes are calculated and to plan for them. Knowing about the Annual Value and the tax rates helps you figure out why you’re paying what you’re paying—and what you might be paying in the future.

So, let’s all stay informed and ready for these changes. And remember, it’s always a good idea to ask questions if something on your tax bill doesn’t make sense!